how much will my credit score increase with a car loan

But theres more than just a score to your credit and lenders tend to look at the bigger picture. Paying off a car loan can allow more breathing space by reducing your monthly expenses.

Does Financing A Car Build Credit

As soon as the account was updated to paid loan on my credit my FICO Score dropped by 4-6 points depending.

. So before you pay off. Oftentimes paying off a car loan will results in a decrease in your credit score because when you pay off your car youre essentially closing an installment loan which often lowers your credit score especially if the installment loan was in good standing and substantially paid off. Ad You Can Increase your Credit Scores for Free only at Experian.

Its important to understand what is considered by the term good so that you can ensure that you get the auto loan that you want. Ad Quick Decisions Low Rates Easy Application. Though your credit mix only makes up 10 percent of your credit score having different types of credit accounts still helps more than it hurts.

But if you have a low credit score like in the 400s making regular and on-time payments can raise your credit score considerably over the long term. If you have a higher debt-to-income ratio paying off a car loan can raise your credit score. While FICO claims credit card utilization makes up around 30 percent of your credit score VantageScore claims it accounts for 23 percent of your credit score.

Ad Get Pre-Approved To See Your Real Terms For Every Vehicle. If you take out a massive car loan or if you already have significant other debts your car loan could actually harm your credit. As you make on-time loan payments an auto loan will improve your credit score.

When you finance a vehicle the amount you borrow is debt and the amount of debt you have plays a major role in calculating your credit score. Free Credit Monitoring and Alerts Included. I monitor my own credit closely and recently finished paying a 36-month car lease.

Having installment loans like auto loans and mortgages and revolving credit such as credit cards and store credit gives your credit profile a boost. Credit mix 10 - the diversity of your credit sources student loans mortgages auto loans etc. Before we dive deep to answer your question its important to know that credit scoring models differTwo great examples of that is FICO and VantageScore which is 2 of the most commonly used credit scoring systems.

Thats because youre reducing your length of credit history. If you already have a credit score in the 800s and you make payments on a car loan it wont increase much because the highest score is 850. The impact of paying off your car loan could have a bigger influence on your credit score if you have a thin file which means a sparse credit history.

Your score will increase as it satisfies all of the factors the contribute to a credit score adding to your payment history amounts owed length of credit history new credit and credit mix. If your auto loan is the only thing being actively reported on your credit reports then completing the loan could harm your credit score a little more than someone else with a variety of active credit because you closed your. How Fast Will A Car Loan Raise My Credit Score.

If your refinancing goal is lower monthly payments however you may be able to find an auto lender that specializes in. But on the other hand if you are looking to establish credit paying off the loan wont help improve your credit. Your credit score factors in the average age of your accounts and taking out an auto loan lowers it.

Your auto loan each month you should see an improvement in your credit score especially if it reaches important milestones such as six months one year and eighteen months. Your FICO credit score can range anywhere from 300 to 850. In general credit bureaus refer to anything over 670 as a good credit score.

Generally speaking if youre shopping for an auto loan within a 30-day period all those hard inquiries that are listed on your credit report. The length of your credit history accounts for 15 percent of your FICO score so its impact should be modest. The prime borrower will pay about 1614 in interest for a total cost of 11614.

Your credit score will not increase after paying off your car loan. New credit 10 - the number of times youve opened accounts and applied for credit. If your car loan is your oldest account your credit score will decrease when you pay it off.

The prime borrower is offered the average 605 rate. However opening a new account can have a greater impact if you have a low number of accounts. Length of credit history 15 - the number of years youve been using credit and the average age of your accounts.

Over time the subprime borrower will pay back 15164 or 5164 in interest. The FICO scoring model puts a 30 weight on amounts owed which has to do with how much debt you have and your credit. Your credit bureaus report your payment toward your loan every time you pay back your loan.

If youve only used credit cards adding a car loan will give your credit the. Thats a difference of 3550 in interest paid and in this case it all came down to credit scores. If your credit scores have dropped significantly since you took out your original car loan it may be difficult to find refinancing that saves you money because lenders typically charge higher interest rates to applicants with lower credit scores.

Credit scoring models consider the average age of your accounts so if youve had your car loan open for a few years the average age of your accounts is going to decrease when you pay off the loan. Your overall debt load is the second most important factor in your credit score contributing to 30 percent of the total. New Credit Scores Take Effect Immediately.

Those closer to 300 are considered in the poor range and those closer to 850 are considered in the. Car Loan Debt Load. Other Ways to Improve Your Credit Score.

What S The Minimum Credit Score For A Car Loan Credit Karma

How To Get A Car Loan With No Credit History Lendingtree

What Credit Score Do I Need To Refinance My Car Loan Rategenius

What Is Considered Bad Credit Legacy Auto Credit

What Is A Good Credit Score Forbes Advisor

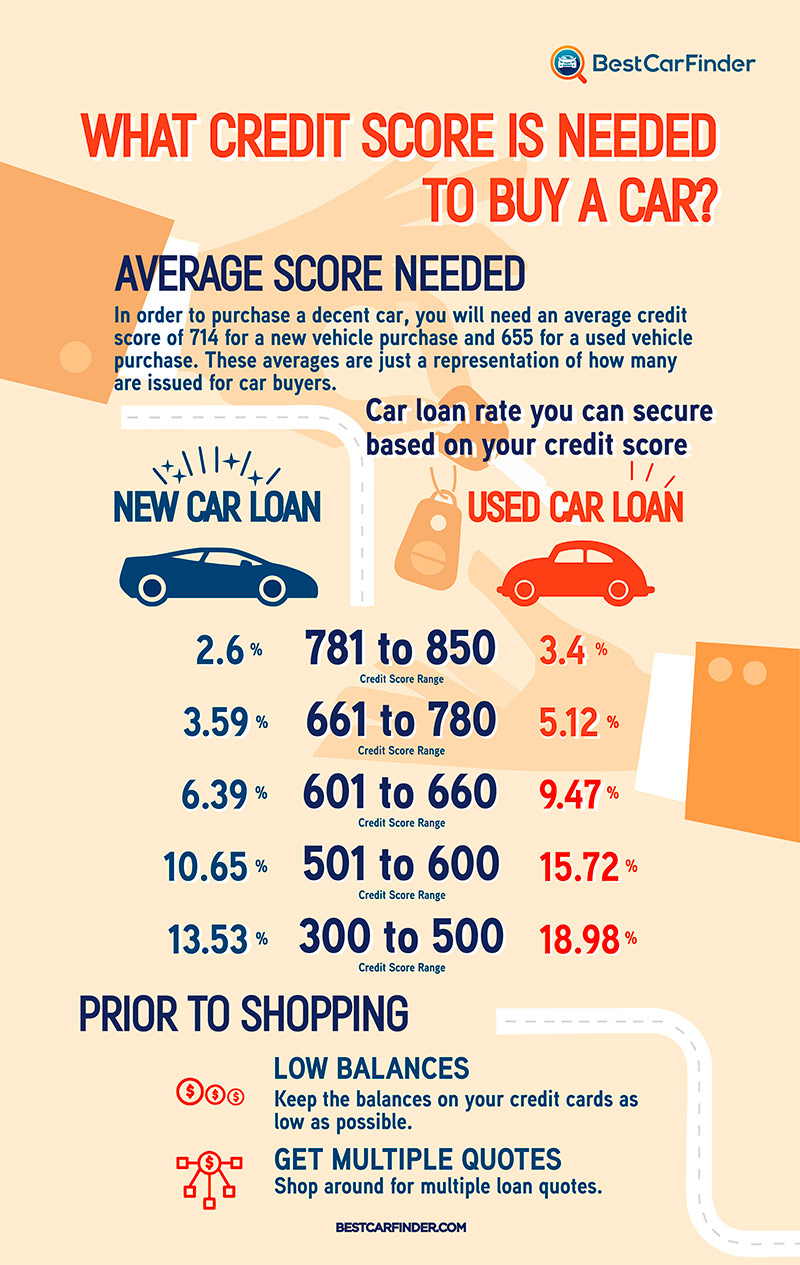

What Credit Score Is Needed To Buy A Car Best Car Finder

:max_bytes(150000):strip_icc()/dotdash_final_800_Plus_Credit_Score_How_to_Make_the_Most_of_It_Dec_2020-01-eab02cc511db4ce19ab3c1869e750d3b.jpg)

800 Plus Credit Score How To Make The Most Of It

Fix Your Credit Best Credit Repair Companies Credit Repair Services Credit Repair Business

/dotdash_final_800_Plus_Credit_Score_How_to_Make_the_Most_of_It_Dec_2020-01-eab02cc511db4ce19ab3c1869e750d3b.jpg)

800 Plus Credit Score How To Make The Most Of It

/best-auto-loan-rates-4173489_FINAL-84fa7faff6244117a47e6641978a86dc.png)

Best Auto Loan Rates Of April 2022

:max_bytes(150000):strip_icc()/what-is-a-good-interest-rate-on-a-car-5176189_v3-fa00f898e38b4fb4b5f14109ea7a478c.png)

What Is A Good Interest Rate On A Car Loan

What Is A Good Credit Score Forbes Advisor

How To Get A Car Loan With Bad Credit Credit Karma

How To Get A Car Loan With Bad Credit Forbes Advisor

What Credit Score Is Needed To Buy A Car Lendingtree

How Fast Will A Car Loan Raise My Credit Score Plus The Secret To Rate Shopping

Check Out Average Auto Loan Rates According To Credit Score Roadloans Car Loans Consolidate Credit Card Debt Credit Score